Retirement Benefits

The following applies for each of category of your retirement savings:

| Vested pot: “OLD” savings up to 31 August 2024 | Savings pot: “EMERGENCY” money – only for emergencies! | Retirement pot: NO TOUCHING |

| You may withdraw a portion in cash. | You may withdraw the full balance in cash. | This money must be used to purchase an annuity when you retire, unless the amount is less than R165 000, in which case you can take everything in cash. |

| This benefit will be taxed in line with the tax table for retirement. | This benefit will be taxed in line with the tax table for retirement. | The annuity that you buy will be taxed as and when you receive your monthly pension income, in line with the tax tables for retirees. |

| RETIREMENT GUIDE |

| The retirement guide will provide you with all of the most important retirement information. |

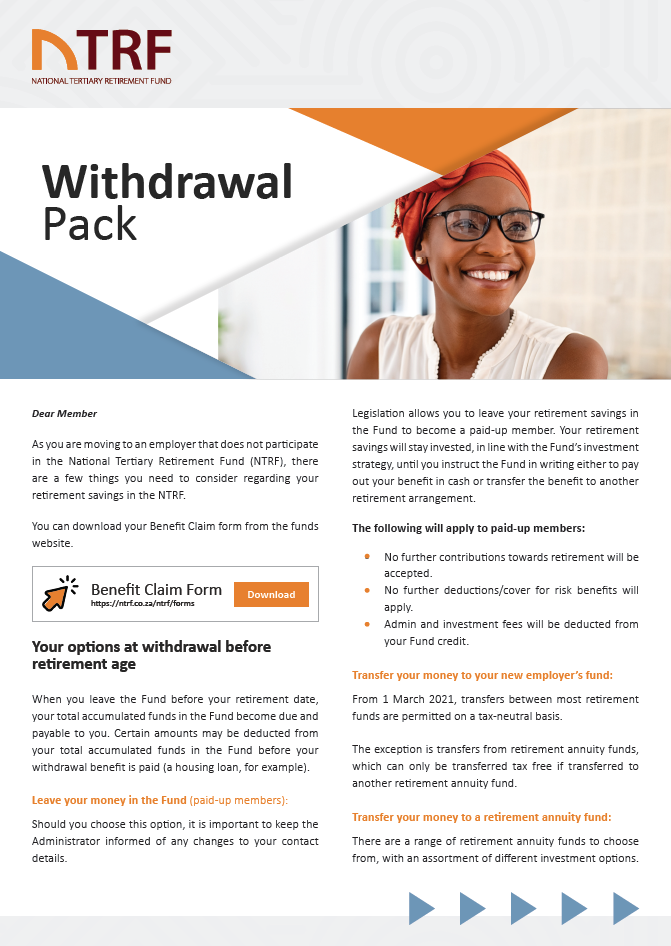

| WITHDRAWAL GUIDE |

|

The Tax Formula in terms of the tax applicable to the benefits taken in cash is prescribed by SARS.

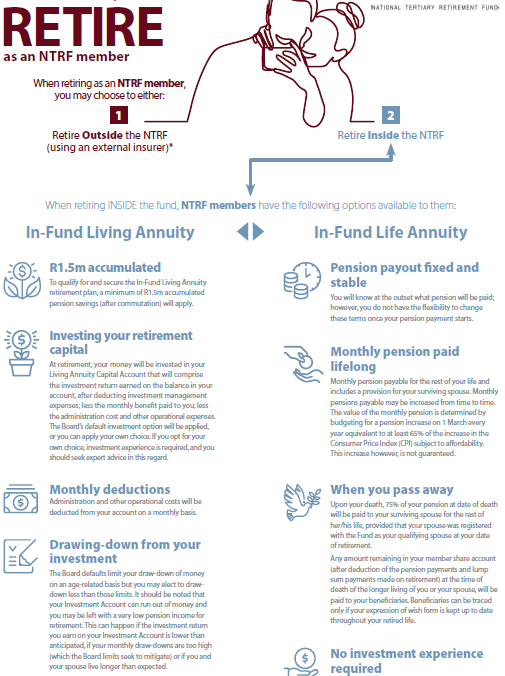

The options available to you when you retire from the NTRF

Click here to view the infographic.

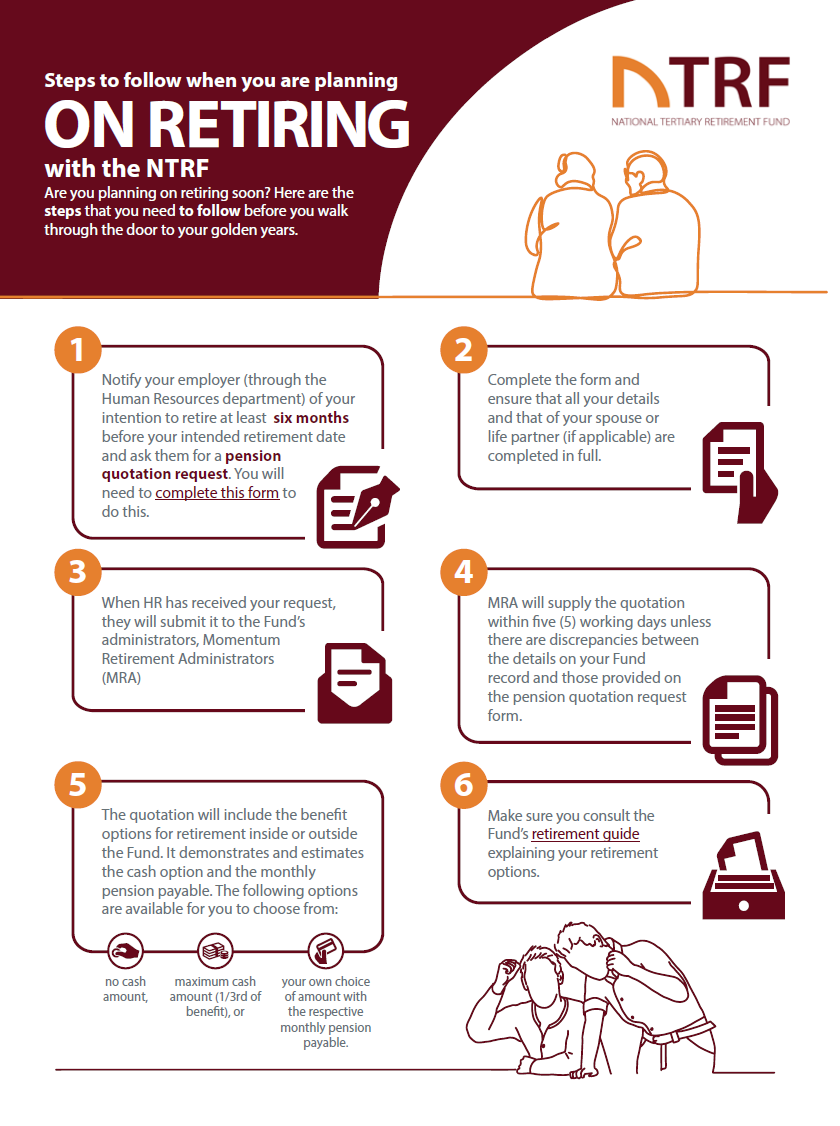

Steps to follow when you are planning on retiring with the NTRF

Click here to view the infographic.