Withdrawal Benefits

The following applies to each category of your retirement savings:

| Vested pot: “OLD” savings up to 31 August 2024 | Savings pot: “EMERGENCY” money – only for emergencies! | Retirement pot: NO TOUCHING |

| You may withdraw the full balance. | You can withdraw the full balance, but only once per tax year unless your savings pot is less than R2,000, in which case you can withdraw the full amount. | You cannot make withdrawals from this pot. This money must be used to purchase an annuity when you retire, unless the amount is less than R165 000, in which case you can take it in cash. |

| This benefit will be taxed in line with the tax table for withdrawal. | Any withdrawals from this pot before retirement will be taxed at your marginal rate – in other words, the same rate as your income. At retirement, it will be taxed in line with the retirement tax tables. |

The annuity that you buy will be taxed as and when you receive your monthly pension income, in line with the tax tables for retirees. |

| WITHDRAWAL GUIDE |

|

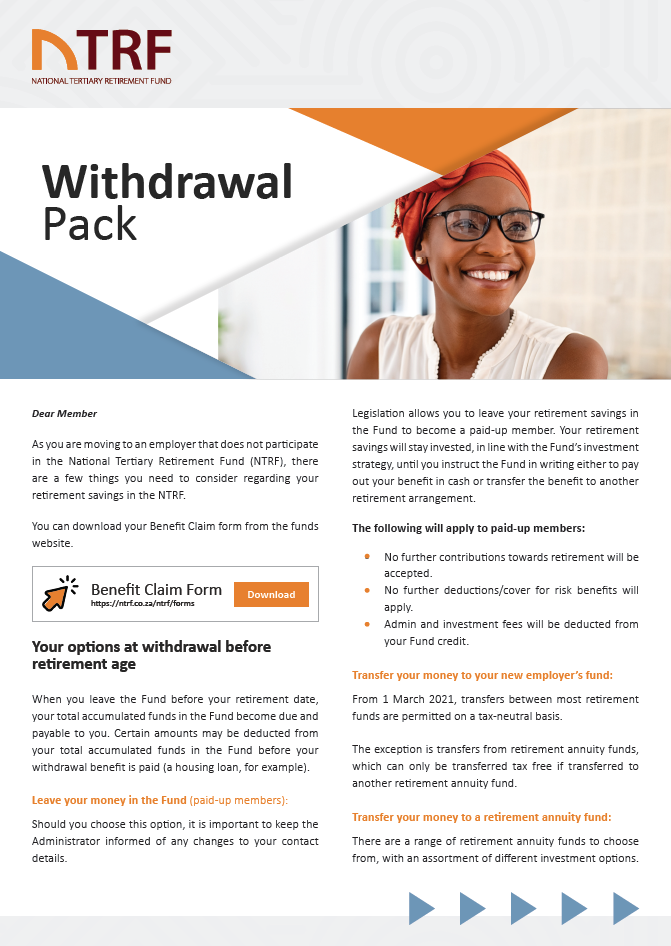

When you leave the Fund before your retirement date, your total accumulated funds in the Fund become due and payable to you. Certain amounts may be deducted from your total accumulated funds in the Fund before your withdrawal benefit is paid (a housing loan for example).

The options may sound technical, but it's not that complicated - let's take a look at each of these:

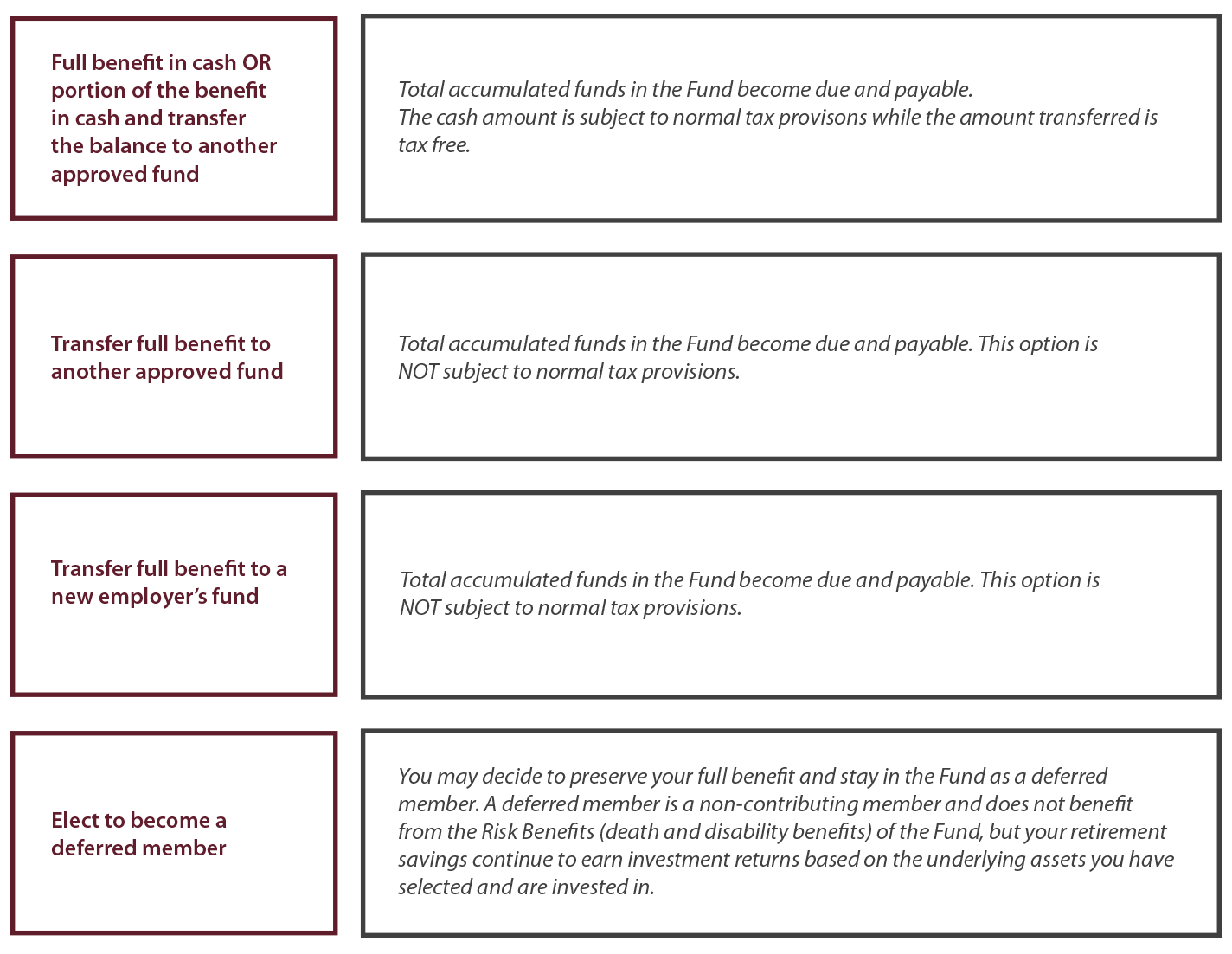

Take your money in cash

This is a tempting option for some of us. Finally we have some extra money to spend on luxuries or to pay off excess debt. However, this might mean the difference between a worry-free retirement, and one filled with financial struggles. If you take your money in cash, you will be taxed on the full benefit and only a small portion is tax free (for more information, see the Taxation section).

| Please note: Consider all the options carefully before electing cash. Calculate how much tax you’ll pay. |

Transfer your money to your new employer's retirement fund

If you transfer your benefit to your new employer’s fund, when you retire from that fund, you will only be allowed to take a maximum of one-third of your benefit in cash and the balance will be used to provide you with a pension in terms of that fund’s rules. It is recommended that you discuss the options available to you with your new employer and that all implications of this option are explained and understood by you before selecting this option. This is a tax free transfer.

There might be some reasons why you elect not to transfer your money to your new employer's fund, but not to worry, you have two other options.

There might be some reasons why you elect not to transfer your money to your new employer's fund, but not to worry, you have two other options.

Transfer your money to a Retirement Annuity Fund

There are a range of retirement annuity funds to choose from with an assortment of different investment options. Speak to your financial advisor regarding the different options available to you. A retirement annuity works exactly like a pension fund, in that at retirement you will only get one third in cash and the balance must be used to purchase a life-long pension from a registered insurer.

You may make monthly contributions towards a retirement annuity, and a certain percentage of these contributions is tax deductible. This is a tax free transfer.

| Please note: You do not have a withdrawal benefit in a retirement annuity fund. Therefore, you can only get your money out at retirement, between ages 55 - 70 years. |

Transfer your money to a Preservation Fund

There is a range of preservation funds to choose from with an assortment of different investment options. Speak to your financial advisor regarding the different options available to you. You can retire from a preservation fund between the ages of 55 - 70 years. You may not make monthly contributions towards a preservation fund. This is a tax free transfer.

|

|

Please note:

You have only ONE withdrawal from a preservation fund. This can be the entire amount, or a portion. This withdrawal is subject to tax. A cash withdrawal from a preservation fund is not encouraged as it could lead to insufficient retirement provision at the end of your working life. If you have an outstanding housing loan that is settled or an amount payable to your spouse, that will NOT be seen as your once off withdrawal and you will still be able to get your money out of the preservation fund before you retire.

|

Deferred retirement (become a paid-up member)

You may choose to preserve your retirement savings in the Fund until the date on which you want to start drawing a pension. Administration costs are still deducted from your investments on a monthly basis.

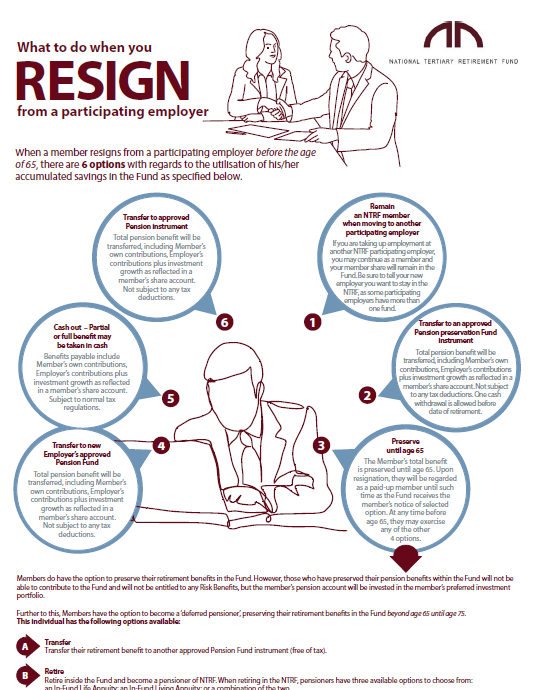

What to do when you resign from a participating employer

Click here to view the infographic.