Divorce

.png) |

Divorce and your retirement savings Your pension or provident fund savings form part of your overall assets. Understand what happens to your retirement benefits if you divorce your spouse. |

| Please note: It is your responsibility to notify the Fund of a divorce order and provide the Fund with a copy thereof and your ex-spouse’s responsibility to apply for the settlement amount from the Fund. |

The divorce payment will be deducted proportionally from the Vested Pot, your Savings Pot and your Retirement Pot.

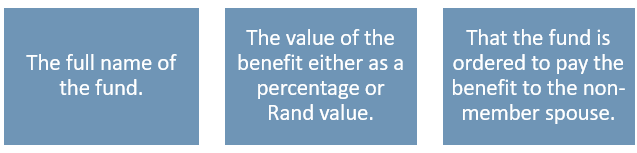

Information to be contained in my Divorce Order

• The percentage (0-100%) or amount to be paid to the ex-spouse

• An order to the Fund to pay the pension interest of the ex-spouse directly to him/her.

Administrator's procedure

Please forward your Final Order of Divorce and settlement agreement (if a settlement agreement was made an order of court) to mra.courtorders@momentum.co.za. Also include contact details of your ex-spouse.

Both documents must contain the stamp of the court and if the order is referring to a settlement agreement Mark “B” is made an Order of Court, the settlement agreement must be mark as indicated on the final order of divorce.

On receipt of the aforementioned documents, it will be sent to our legal department that will confirm if the wording is in line with the legislation.

Once this confirmation is received back, and the order is confirmed binding, we will start with the disinvestment of the divorce portion from your benefit. Once this portion is disinvested you will receive a letter confirming the disinvestment and the amount that was disinvested from your benefit.

During this period, we will also contact your ex-spouse and provide him/her with a letter to request his/her documentation. The documentation that will be requested is an application form (will be sent with his/her letter), identity document, bank statement and tax number.